Looking back to a year ago, as the US presidential race was entering its final stretch, Donald Trump’s campaign was faltering and the would-be President was stumbling from one verbal blunder to another. Reminiscent of his recent controversial remarks on Charlottesville, Mr. Trump was caught off-camera making sexist comments which appeared to alienate a critical mass of female voters. His campaign was in disarray and staff changes were announced daily, again much like today. Figureheads of the Republican Party, like Speaker Paul Ryan, were vehemently objecting to endorse or even appear near their doomed candidate. Pundits were predicting the end of “comet Trump”. A trailing 3% in the polls became a near-certainty of loss, in the traditional way modern day column writers take positions rather than coolly analyse numbers. Nate Silver, a prominent poll aggregator, was criticized heavily for implying that Mr. Trump’s chances of success were a little over 30%, rather than 0, and ultra-Liberal Michael Moor’s warning that his home states, the “rust belt” in the North, would vote Republican was dismissed as a rant. Financial experts had predicted that a Trump Presidency was a fundamental risk to the markets.

Then came the bounce on the trampoline. Mr. Trump won the Presidency in the eleventh hour, snatching the Northern key states from Ms. Clinton by a narrow margin. 51% of white women voted for him, over the possibility of the first female leader of the free world. Republicans acted on realism rather than principle and quickly turned around, comprehending the possibilities arising from controlling both Congress and the White House. As for the markets? In the space of 12 hours, the Dow turned an 800 point loss into a 200 point gain. Inflation expectations jumped as the predicted growth spurt would put further upward pressure on prices. Financials and the S&P 500 rallied on the hope that Mr. Trump would deregulate banks, decrease corporate and personal taxes, repeal and replace Obamacare and usher in a new era of corporatism. Infrastructure also rallied, as the incoming government had promised a massive increase in infrastructure spending. Worries over global trade, relationships with Russia and tensions with North Korea were quickly dismissed on a near-certainty that the realities of office would prevail over the most controversial elements of Mr. Trump’s agenda. Traders, much like commentators, chose to see reality through their own coloured lenses, focusing on the pay-off and ignoring the risks they themselves had warned about.

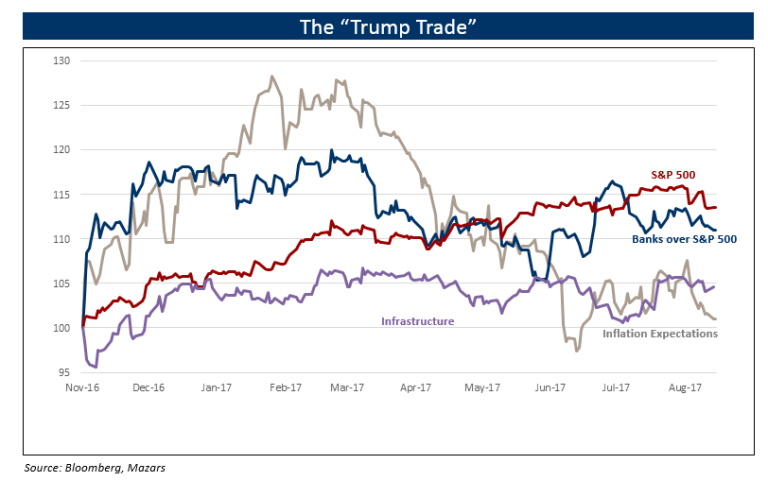

Eight months later, gravity once again took hold. Much like previous Presidents and largely every human being on the planet, with the possible exception of legendary action hero Chuck Norris, there are things Mr. Trump can and can’t do. On the list of things he can do, the most important is bank deregulation, which doesn’t require significant Congress approval. The administration has already filled Mr. Tarullo’s Fed seat, as the person responsible for regulating the banking system and has been quietly working towards relaxing post-crisis imposed rules on Wall Street. Financials have well outperformed the S&P 500 since 8 November.

Of things Mr. Trump can’t do, one is to collaborate with either a Republican Party increasingly sceptical of his leadership style or with a Democratic Party which has been desperately trying to re-connect with its blue collar and more left leaning base. Markets are slowly realising that those items which require Congress approval could be watered down, delayed or even cancelled. The Obamacare repeal, the top item in the Republican agenda for almost a decade, failed to clear the Senate in the summer, sending a clear message to traders and asset allocators that they should moderate expectations on what Republicans can agree on. The danger, experts now acknowledge, is that in a year’s time Congress will be too focused on the Mid-Term elections, which could cost the GOP the control of the House and see the return of gridlock. This puts a 365-day timer on the most important legislative items markets are watching. Corporate tax reductions are very high on both the President’s and the overall Republican agenda, which is why stocks continue to trade near highs, on the expectation that some reduction in taxes will be agreed upon.

However, besides a healthy financials rally and overall stock market buoyance, the other two elements of the Trump trade, inflation expectations and infrastructure, are now near pre-election levels. Lower inflation expectations, in part because of the Fed’s tightening cycle and lower oil prices, mainly reflected predictions for a significant acceleration in GDP growth. Hopes that infrastructure spending would increase are also waning as it becomes clear that key portions of the Republican caucus will not tolerate a large deficit to satisfy Mr. Trump’s extravagant campaign pledges, especially as his popularity wanes. In response the President has decided to double down, threatening to shut down the government if he doesn’t get funding for his wall separating Mexico.

Markets are less about current information, which we all possess and more about expectations on what future the current conditions will usher. The ultra-liquid and financially stable environment we still live in allows for exuberance and hopes to prevail over fear and bearishness, which is why markets continue to err on the upside rather than the downside. As long-term investors, however, we should be less sentimental and mostly pragmatic as to what this truly unique American government can and cannot achieve.

Overall, we are still positive that some market-friendly legislation will come through. The Republican Party can’t afford to alienate its own President. First, because it might jeopardise some parts of its supporter base. More importantly, because, in the face of a tough Mid-Term election, the path towards maintaining control of Congress is narrow, and goes through a modicum of legislative successes. At either side of the path, is endless debate about Russia, Charlottesville, Mr. Bannon and Twitter. And at the end of the path stands the President, who, if scorned, may veto legislation he doesn’t like, or indeed force a government shutdown. We expect some sort of compromise, but are fully aware that the clock is ticking.